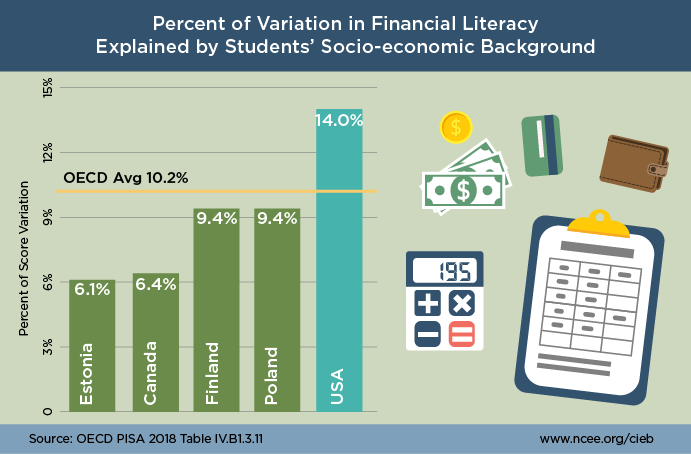

Families around the world are under financial strain due the economic disruption of the coronavirus pandemic. As such, financial literacy is increasingly important for students. The 2018 Program for International Student Assessment (PISA) included an optional section on financial literacy. This section assessed 15-year-olds’ experience with and knowledge about money and their ability to apply their accumulated knowledge and skills to real-life situations involving financial issues and decisions. The results show that while on average students in the United States performed at about the OECD average on financial literacy, the gap in financial literacy levels between advantaged and disadvantaged students is especially wide in the U.S. The relationship between students’ socio-economic background and financial literacy is stronger in the U.S. than in all but one other participating OECD country (the Slovak Republic), and much stronger than in top-performing countries like Estonia, Canada and Finland—as shown in the chart above. The U.S. also has a higher ratio of students performing at the lowest levels on the financial literacy assessment, and the correlation between student performance on mathematics—where U.S. student performance was at its weakest—and financial literacy in the U.S. is particularly strong.

Learn how top-performing education systems are working to equip all students with the skills they need to succeed in a fast changing world in our country profiles.